Published

3 months agoon

By

James

Dow Jones futures showed little movement early Friday, with the S&P 500 and Nasdaq futures also holding steady, as investors await the release of the February jobs report. Among notable stocks, Broadcom (AVGO) and Costco Wholesale (COST) are in focus.

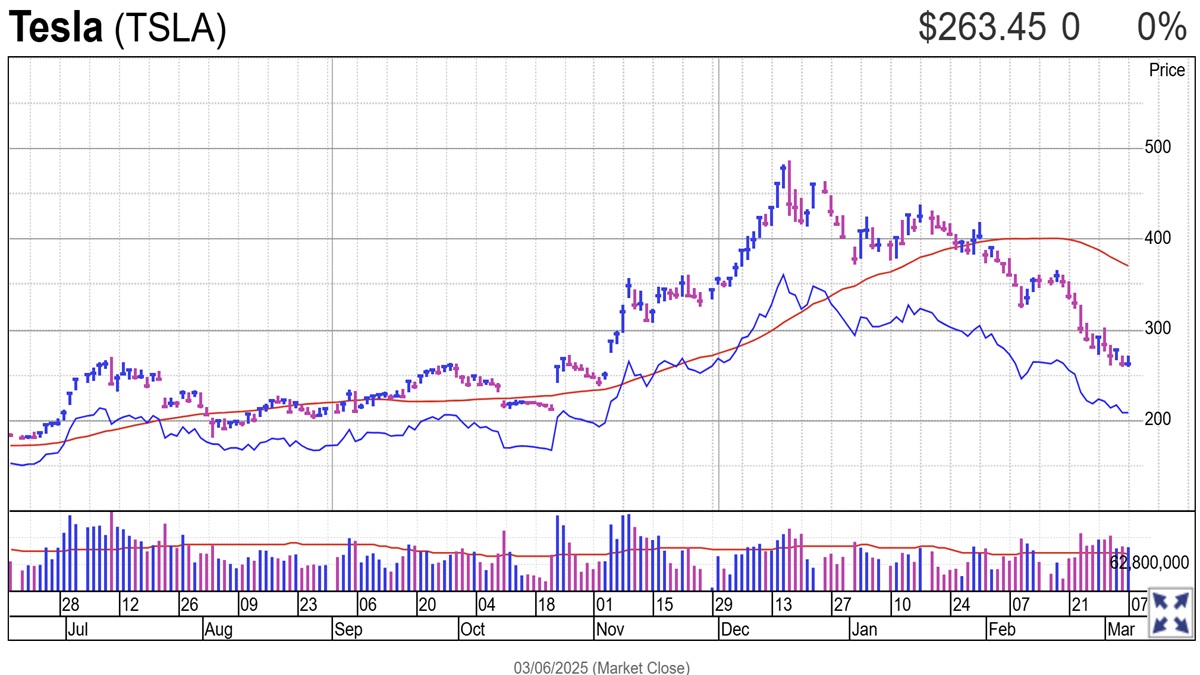

On Thursday, the stock market faced significant losses, with the Nasdaq slipping below its 200-day moving average, driven by concerns over Trump’s tariff policies. The S&P 500 also dipped below its 200-day line and Tuesday’s low. Stocks like Tesla (TSLA), Nvidia (NVDA), and Palantir Technologies (PLTR) were among the biggest losers.

Even some previously resilient stocks such as Netflix (NFLX) and DoorDash (DASH) saw significant declines, falling below their 50-day moving averages.

While the Nasdaq’s rally attempt remains in progress, it is still tentative, with the market overall in correction territory. However, international markets like Hong Kong’s Hang Seng and Germany’s DAX are seeing gains, benefiting from overseas stimulus efforts.

Dow Futures Overview

Dow Jones futures were flat versus fair value. The S&P 500 futures gained 0.1%, while the Nasdaq 100 futures rose 0.2%, driven by Broadcom’s strong performance. Despite early gains, futures pared back some overnight advances.

Treasury yields saw a slight dip, with the 10-year yield dropping to 4.25%, and crude oil prices rose more than 1%.

The upcoming jobs report is expected to significantly impact Dow futures, Treasury yields, and market sentiment overall.

Bitcoin and Tariffs

Late Thursday, President Trump signed an executive order establishing a Bitcoin Strategic Reserve funded by seized cryptocurrency, though the Bitcoin price slightly declined overnight.

Additionally, Trump announced a delay in tariffs on Canadian and Mexican goods covered by the United States-Mexico-Canada Agreement, extending the pause until April 2. This includes around half of Mexican imports and 38% of Canadian goods. Earlier, Trump had provided a one-month exemption for automakers.

However, the market remains uncertain with looming tariffs, which could lead to delays in hiring or investment decisions as companies await clarity.

Trump addressed the recent market decline, blaming “globalist countries and companies” rather than focusing on the stock market’s performance.

Earnings Reports: Broadcom and Costco

Broadcom’s stock surged after the company exceeded earnings expectations and issued a positive outlook. However, the stock had dropped 6.3% during regular trading hours on Thursday, falling below its 200-day moving average due to market volatility.

Costco’s earnings came in below forecasts, though its revenue exceeded estimates. Costco stock fell 2% on Thursday, consolidating within a buy zone. Smaller rival BJ’s Wholesale (BJ) saw strong performance, breaking out from a base following its earnings report.

In contrast, Samsara (IOT) and Hewlett Packard Enterprise (HPE) suffered steep declines after their earnings announcements.

Stock Market Performance: A Volatile Day

On Thursday, the stock market saw significant sell-offs after a brief rally on Wednesday, despite Trump’s short-term tariff reprieves. Investors are growing weary of the repeated tariff delays, resulting in increased market volatility.

The Dow Jones Industrial Average dropped 1%, the S&P 500 fell 1.8%, and the Nasdaq composite slid 2.6%, marking its lowest close in five months. The Russell 2000, a small-cap index, shed 1.6%.

The S&P 500 dipped below its Tuesday lows, signaling a failure in its rally attempt. The Nasdaq, however, remains in the midst of its fourth day of rallying, which could potentially lead to a follow-through day, depending on the February jobs report.

Energy and Treasury Yields

U.S. crude oil prices rose slightly to $66.36 per barrel. Treasury yields continued to rise, with the 10-year yield at 4.28%, up two basis points from the previous session, signaling a bounce back from earlier lows.

ETFs and Growth Stocks

Among growth-focused ETFs, the Innovator IBD 50 ETF (FFTY) fell 5.1%, the iShares Expanded Tech-Software Sector ETF (IGV) dropped 3.8%, and the VanEck Vectors Semiconductor ETF (SMH) lost 4.2%, largely due to declines in key stocks like Palantir, Nvidia, and Marvell.

The ARK Innovation ETF (ARKK) saw a 4.7% drop, while the ARK Genomics ETF (ARKG) fell 3.2%. Tesla continues to be the largest holding in Ark Invest’s ETFs.

Stocks in Focus: Tesla, Palantir, Nvidia, Netflix, and DoorDash

Tesla (TSLA) fell 5.6%, marking its seventh consecutive weekly loss. The stock has been under pressure following lowered price targets and concerns about potential delivery misses.

Palantir (PLTR) and Nvidia (NVDA) also suffered sharp declines, with Palantir losing 10.7% and Nvidia dropping 5.7%. Both stocks fell below key technical levels, signaling further weakness.

Netflix and DoorDash also saw significant losses, with Netflix dropping 8.5% and DoorDash losing 7.7%, both falling below their respective 50-day moving averages.

What Investors Should Do Now

The stock market remains volatile, with sharp intraday swings driven by headlines. While a rally attempt is still underway, it’s prudent for most investors to wait for a confirmed follow-through day before making any major moves.

In a correction, the priority is to preserve both financial and mental capital. Now is an ideal time to update watchlists, focusing on stocks with relative strength and potential for future growth. Consider diversifying investments, including exploring international markets through stocks or ETFs, as U.S. stocks like Tesla, Nvidia, and Palantir may take longer to recover from their current slump

The Richest Person in Bavaria: Susanne Klatten’s Secluded Life

Meghan Markle Launches Online Fashion Shop for Fans

Bulgarian Consumers Boycott Supermarkets Over Rising Food Prices

Steve Wozniak Criticizes Tesla: “Nothing Makes Sense in This Car”

Tesla Warns of Potential Trade War, Urges U.S. Government to Reconsider Tariffs

BMW’s Power Shift The Man Who Might Lead the Future

Trump’s Rift with Europe: China Senses Its Opportunity